As you’ve probably heard, Congress is looking to overhaul the tax code. Flashy TV and social media ads paint tax reform as a means for improving the financial security of middle class families. But the release of the House and Senate’s tax plans make clear that each proposal, taken as a whole, falls short in bolstering, and in many cases harms, our generation’s financial footing.

The House bill is especially bad–it wholly removes most of the higher education tax provisions at the expense of students and families. In full, the House bill strips out $65B in benefits for students and loan borrowers, weakening investment in our higher education system to give millionaires and billionaires a tax cut.

- The bill would consolidate three existing higher education tax credits into the most popular one, the American Opportunity Tax Credit. While simplification, when done right, is appealing to ensure taxpayers can access the correct benefits, this consolidation eliminates $17.5 billion in taxpayers’ investment in higher education at a time families are struggling to afford college. Narrowed eligibility and onerous verification procedures would take an additional $600 million out of higher education. It is a net negative for students, and especially hurts older students who are going back to school and students with immigrant parents.

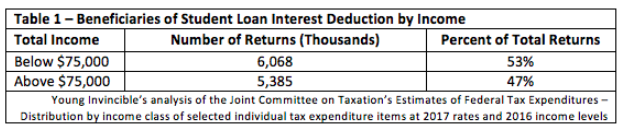

- The bill also eliminates the student loan interest deduction, taken by 12 million borrowers last year. While this deduction helps borrowers up and down the income scale, the majority of benefits are actually taken by households earning less than $75,000 a year.

- Additionally, the bill would tax graduate student tuition waivers, potentially placing a population of students doing essential research in financial distress through taxing money that students never actually receive. Young Invincibles estimates that both African American students and students earning below $50,000 disproportionately benefit from the tuition waiver. Neither of these groups deserve a tax hike, and such a move could make it harder to narrow racial divides in education attainment.

While the Senate bill does not cut these provisions, it similarly fails to invest in or expand provisions that would help our generation pay for college or obtain financial security. The Senate plan would also retreat from the progress we have made in expanding our generation’s access to health care coverage by repealing the ACA’s individual mandate. This would increase the number of uninsured by 13 million people, increase premiums for consumers, and destabilize the health insurance markets.

These are just some of the reasons the public is overwhelmingly skeptical that tax reform will help low- and middle-income families. Republicans in Congress should start over and pursue reforms that would make it easier for young people to afford college and achieve financial security.